Blog

Keep up to date with our news, tips & tricks, and latest information!

A Tax Treatment Primer: Roth IRA vs. Traditional IRA

Jeff Martin, CRPC®

It’s paramount to understand the tax treatment of the various types of retirement accounts upon distributions. Roth IRAs and Traditional IRAs each have different tax implications and features that impact one's retirement strategy.

Understanding Roth IRAs

Roth IRAs offer tax-free growth and tax-free withdrawals in retirement. It is funded with after-tax dollars, meaning there are no tax deductions for contributions. However, this sets up the benefit of tax-free retirement income in the future. Here are things investors must know about Roth IRAs:

- Non-deductible contributions— Roth IRA contributions are made with after-tax dollars and are therefore not deductible on an income tax return.

- Tax-free growth— The investments in a Roth IRA grow tax-free, and the owner will not owe any taxes on dividends, interest, or capital gains—allowing for compound growth without tax implications.

- Tax-free withdrawals— Qualified withdrawals from a Roth IRA are tax-free as long as the account has been open for at least 5 years and the account owner is age 59½ or older.

Traditional IRAs

more2025-2026 Tax Season: New Deductions and Required Forms for Filing

Jeff Martin, CRPC®

The passage of the federal One Big Beautiful Bill in 2025 dramatically affects business and personal income taxes, as well as payroll W-2 reporting for 2025. While many deductions and credits remain the same, the following are notable changes that may impact those with the following situations:

Tips and overtime income - If you have W2 tip income or overtime income, there should be data in W2 Box 14 or a supplemental notice from the employer regarding qualifying amounts related to these 2 specific items:

Tips - deduction of up to $25,000 per taxpayer with phaseout for Modified Adjusted Gross Income (MAGI) over $150,000 (over $300,000 for Married Filing Jointly).

Working overtime - deduction of up to $12,500 per taxpayer with phaseout for MAGI over $150,000 (over $300,000 for Married Filing Jointly).

Social Security recipients - There is an additional $6,000 per-person senior Social Security deduction for 2025 – 2028 for those age 65 and older, with a phaseout for MAGI over $75,000 (over $150,000 for Married Filing Jointly). For those receiving Social Security, this is a favorable change that may help reduce income taxes.

moreHow Political Unrest May Impact a Portfolio

Jeff Martin, CRPC®

Investing in the financial markets requires a keen understanding of global events. Among these, political unrest counts as a significant factor that may influence an investment portfolio. Understanding the potential implications may help investors create a strategy to safeguard their investments and possibly take advantage of arising opportunities.

Geopolitical risks and the financial market

Political instability and unrest can breed uncertainty in the financial markets. Geopolitical risks are typically associated with changes in:

- A country's political system or government

- Fluctuations in foreign policy

- Political violence

- Threats of such disruptions

An environment of political unrest often prompts investors to reassess and sell off investments with assumed risk, driving price fluctuations in equities, bonds, commodities, and currencies.

Direct impact on the investment portfolio

The influence of political unrest can be direct or indirect on a portfolio. For instance, if direct investments in a country experiencing political instability are represented in the portfolio, the value of the assets may decline as investors liquidate these holdings and move toward less risk-averse assets.

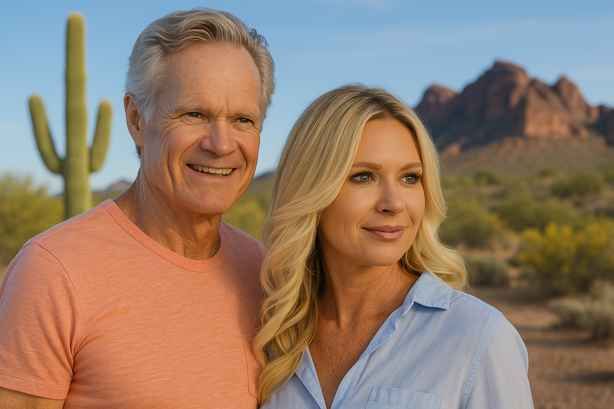

morePre-Wedding Planning: 8 Tips for Financial Bliss

Jeff Martin, CRPC®

For those preparing to wed, planning their future finances together may help strengthen their relationship. Marriage is not just a romantic commitment but also a financial partnership.

Here's a guide to help those preparing to ‘tie the knot’ work toward financial bliss before the marriage vows are exchanged.

Tip #1 – Engage in open conversations.

Transparency is key to an independent future. Both partners should share their income details, assets, liabilities, and financial obligations. Discuss short-term and long-term financial goals, which might include:

- Saving for a vacation

- Buying a home

- Planning for a family

- Preparing for retirement

Being open about these matters will help to align financial dreams and expectations.

Tip #2 - Prepare a joint budget.

Track income and expenses to help understand each partner's overall financial health. Consider lifestyle changes that could affect the monthly budget, such as moving to a new city or starting a family. The budget should reflect this and other factors, such as:

- Fixed expenses: Rent or mortgage, utilities, insurance, etc.

- Variable expenses: Groceries, entertainment, travel, etc.

- Savings: Emergency fund, retirement savings, other goals

Financial Planning for a Couple’s Age Gap in 2026

Jeff Martin, CRPC®

Couples usually don’t retire at the same time when they have an ‘age gap’ between them. An age gap relationship is one where there is eleven or more year’s age difference between them. Age gap relationships are becoming more common as people are choosing to marry later in life, remarry or start a life-partnership with someone significantly younger.

According to a study from the National Center for Health Studies, the average woman is living 81.1 years compared to 74 years in 1960; the average man is living 76.1 years compared to 67 years in 1960. The increase in life expectancy is helping to change the age differences in many couples, making financial planning even more critical.

In age gap relationships one member continues to work for a decade or longer than the other. The drawing of retirement assets and social security income earlier for one member, coupled with differing longevity factors presents a planning challenge compared to other couples.

Age gap couples may have up to a half-generation between their ages and should consider planning for two different scenarios to reflect their age difference. These couples shouldn’t rely on a financial plan based only on the older member’s financial information and longevity factors. Some things to consider for these couples:

moreAI and Finance: The Pros and Cons

Jeff Martin, CRPC®

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines. These machines, programmed to think like humans and, more importantly, to learn from experience, embody the concept of AI. With its roots in computer science, AI has made rapid strides across sectors, including finance.

AI in the Finance Sector

In the financial sector, AI is widely used to automate trading, manage investments, detect anomalies, and provide customer service. Because AI can learn and adapt, its algorithms can analyze vast amounts of financial data in record time. This aids in predicting market trends, thereby supporting strategic financial decisions.

Traders are utilizing AI to create predictive models of market trends based on historical data, social media news, and current market conditions. These models help traders to make informed decisions.

AI is also transforming customer service in the finance sector. Chatbots and virtual assistants powered by AI are available 24/7, can handle multiple queries simultaneously, and provide instant responses.

The Pros of AI in Finance

AI offers several advantages in the finance sector:

moreWhat Investors Need to Know About Investment Risk

Jeff Martin, CRPC®

At its core, investment risk is the probability or likelihood of losses relative to the expected return on an investment. In essence, it is the degree of uncertainty about the return on an investment.

It's important to understand that all investments carry some level of risk, and it is directly proportional to returns – the higher the potential returns, the higher the risk.

Types of Risk

There are several kinds of risk that investors must be aware of. Here are some of the more common ones:

- Market risk: The risk arising from fluctuations in the market. It is also known as systematic risk and affects all investments in the market.

- Credit risk: The risk that a debtor will not repay their loans, resulting in a loss for the investor.

- Liquidity risk: This risk arises when an investor cannot buy or sell investments quickly enough in the market without affecting the asset's value.

- Inflation risk: Also known as purchasing power risk, it is the potential for inflation to undermine an investment's returns through eroding its value.

Risk Analysis: The Process

moreThe Fed and Interest Rates

Jeff Martin, CRPC®

The Federal Reserve, commonly known as the Fed, plays a pivotal role in managing the country's monetary policy, primarily by manipulating interest rates. Understanding the reasoning behind the Fed's decisions and the current timing for such adjustments can provide valuable insight.

Why Does the Fed Lower the Federal Funds Rate?

Interest rates are a powerful tool in the Fed's arsenal for controlling inflation and promoting economic stability. Generally, the Fed lowers the Federal Funds interest rate, the rate U.S. banks lend reserves to each other overnight, in response to an economic downturn or to prevent one. Lowering the benchmark federal funds rate makes borrowing less expensive. This, in turn, encourages businesses to invest and consumers to spend, thereby stimulating economic activity.

Moreover, lowering rates can help mitigate the risk of deflation, a scenario in which prices are falling. While this may initially seem beneficial to consumers, deflation can lead to a vicious cycle of decreased spending and economic contraction as individuals and businesses anticipate further price drops. By making borrowing cheaper, lower rates can spur inflation, countering deflationary pressures.

moreUnderstanding the Impacts of the U.S. Government Shutdown

Jeff Martin, CRPC®

The U.S. Government Shutdown is a complex scenario in which Congress and the President disagreed on a plan to fund government operations and agencies and failed to reach a budget agreement. Common areas of dispute included:

· Defense spending

· Healthcare

· Immigration

· Environmental regulations

· Education

Past shutdowns have occurred when negotiations failed regarding the national debt limit, resulting in a breach of the debt ceiling. Additionally, major policy issues have continued to play a critical role in budget disputes. For instance, delayed budget approval regarding the Affordable Care Act, immigration policy, and climate change initiatives became sticking points in negotiations.

Impact of a shutdown

When a government shutdown occurs, all non-essential federal government offices close, affecting many services and operations. Both the federal workforce and the public are directly and indirectly affected by a shutdown.

· Federal workforce: Employees categorized as 'non-essential' - those whose absence would not disrupt functions critical to the protection of life and property. During a shutdown, they are often furloughed or temporarily laid off.

more